Macro in May: Sentiment overtaken by events

Alastair Winter

(Hay una versión en español de este artículo aquí.)

From the outset, 2022 was looking as if it would be difficult to make money. So far in 2022, despite the last-gasp Santa Rally, the wobbles in September and November last year have proved to be a better guide to investor sentiment. Markets are always looking forward and can often ignore unwelcome fundamental events, whether in geopolitics, macroeconomics, asset classes and specific stocks or bonds.

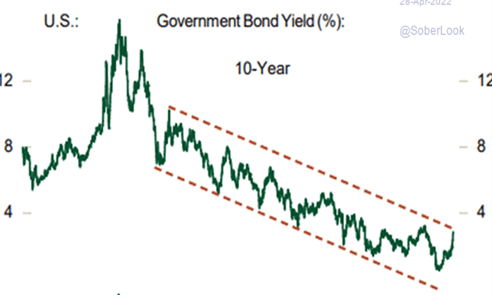

With almost too many developments to contemplate, sentiment in global markets has been struggling to catch up over the last eight months. The decisive factor seems to have been grudging acceptance that the Fed and other central banks really do want, as well as intend, to hike interest rates, irrespective of the state of the global and national economies and irrespective of any consequent market reaction. In technical but less colourful terms, this is putting asset prices under pressure, because real yields (currently negative) will have to go up either because inflation drops back, or nominal yields keep rising, or both.

Figure 1 Secular change: 10-year US Treasury yields 1970-2022

Source: MRB Partners via The Daily Shot

Amid fears of a return to the monetary policy of the 1970s and 1980s when even the most venerable of current fund managers could have scarcely begun their careers, there is an additional contemporary twist in the reversal of years of Quantitative Easing. Accordingly, it is understandable (h/t Charles Darwin) that, in the face of unfamiliar as well as unwelcome developments, most investors (institutional fund managers, hedge funds, individuals, and punters) and corporate executives are having to adapt.

War in Ukraine, surging inflation, central bank hikes, and China’s slowdown have been bundled together in the headlines in the financial press, but the strands need to be separated in order to contemplate what may be coming next.

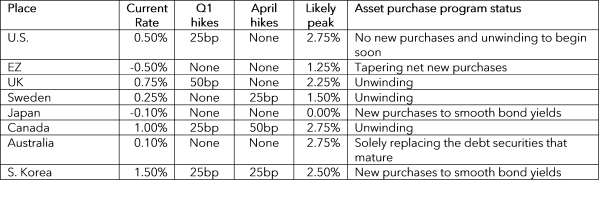

Table 1 Central banks in advanced economies: stability first