Ironic timing of a stock market turnaround

Genevieve Signoret

29 March 2022

(Hay una versión traducida al español aquí)

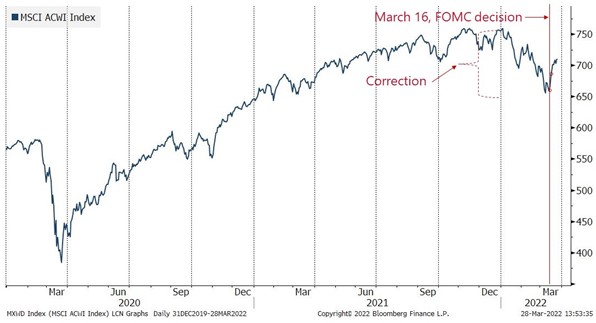

It’s too early to declare the Q1 2022 stock market correction over but, if in fact it is over, then it ended on March 14. And that would be ironic.

March 14 is the last day before the Federal Open Market Committee launched its tightening cycle where it divulged three things, all hawkish:

- An immediate hike in the upper limit of the 25–basis-point target range for the federal funds rate to 0.5%;

- That the Fed would announce the start of balance sheet shrinkage “at a coming meeting”.

- That the central tendency projection by Board members and Bank presidents was that the FOMC would hike rates by another 110–190 basis points.

So much for the view that Fed tightening will inevitably cause the stock market to crash!

Ironically, stock markets rebounded after the Fed started tightening

Chart 1. MSCI All Country World Index (100=31 Dec 1987), since 31 Dec 2019

Research assistance by Estefanía Villeda. Editing by Andrés Aranda.

Comentarios: Deje su comentario.