GameStop: A Reddit toy?

Genevieve Signoret

(Hay una versión traducida al español aquí.)

The GameStop share price has been spiking again, and I can’t fathom why. Which sounds like an argument for not writing a blog entry on GameStop. Yet here I am. Because this morning I woke up thinking, perhaps if I tell the story right up to the point where I cease to understand it, I can use it as a tool with which to teach you some market jargon. For this, my friends, is a story rich in jargon.

What is GameStop?

Think back before Spotify…how did you purchase music? You probably walked into a store and bought a physical compact disc. Well, GameStop is a store you walk into to buy a physical video game disc.

I think you’re starting to see the problem: GameStop has been hit by two headwinds, one we call secular, or long-term, the other we call cyclical, or short-term. The secular headwind is the trend toward the online sale of games for download. The cyclical headwind is, of course, the pandemic.

These headwinds help explain GameStop’s poor share price performance in 2020:

Prior to 2021, for secular and cyclical reasons, GameStop under-performed the overall U.S. stock market

Now, it turns out that you can actually make money on a falling share price if, in advance, you guessed that the price would fall and opened a type of market position that can benefit from that fall. That is to say, if you sold the stock short.

What does it mean to sell a stock short?

To sell a stock short is to borrow shares of a particular company from your brokerage house, sell the borrowed shares today, deposit the proceeds with your brokerage house as collateral, then buy the shares later—hopefully, though not necessarily, at a price lower than that for which you sold it. Once you’ve bought the shares, you use them to pay your loan back to your brokerage house. And, if your guess was correct—that is, if the share price went down—you made money. How can this be?

Remember, to make money in the market, we must buy low and sell high. Successful short sellers aim do that too, but whereas normally we buy the stock first, then sell it, short sellers sell the stock first (we say they sell it short), then buy it.

Before I go with my story, you’re going to need some more terminology:

In referring to selling a stock short, we say we short it, or, we go short.

After having shorted it, we say we’re short that stock, or we hold a short position in it.

Now, note that some hedge funds specialize in short selling.

Wait—what’s a hedge fund?

A hedge fund is a fund for accredited (wealthy) investors that takes large market bets in hopes of outperforming the overall market.

Some hedge funds do it primarily by short selling. And a group of these, prior to January 2021, for the secular and cyclical reasons mentioned above, had bearish views on GameStop and thus were short GameStop.

This is where Reddit and r/wallstreetbets come in.

What are Reddit and r/wallstreetbets?

BBC explains Reddit and r/wallstreetbets more simply than anyone I’ve seen, starting with Reddit:

It’s a social media site – kind of like Twitter or Facebook.

You join forums about particular topics you’re interested in.

There are Love Island forums, football forums, history forums – you name it.

The one that’s important in this story is called wallstreetbets. More than four million people are in it, usually discussing stocks and shares and where they’re going to invest money.

Notice that BBC prints simply wallstreetbets, whereas we follow the Reddit protocol of denoting forum names by preceding them with r/, like this: r/wallstreetbets.

Last January, a group of investors on r/wallstreetbets for some reason decided to gang together to hurt hedge funds by driving up the price of GameStop. The pain they intended to inflict is called “a short squeeze”.

Hold on—what’s a short squeeze?

Remember, to make money speculating on Wall Street, you must buy low and sell high. This means that, if the price of a stock you are short goes up after you sold borrowed shares of it, your short will flop. Also, your collateral on deposit in your margin account will no longer suffice to cover the value of the shares you borrowed, so your brokerage house will now demand that you deposit more collateral.

Now, suppose you remain convinced of your original negative view on the stock and have some extra cash lying around. You can simply deposit more cash into your margin account. However, if the price continues to move up, at some point you’ll run out of available cash and have to close out your short by buying the shares you previously sold and using them to pay back the loan to your broker. This share purchase is going to hurt! Because you’ll pay a higher price for the shares than the price you had sold them for.

Now, suppose that (a) you are a hedge fund, and (b) not just you but also lots of your competitors had shorted the stock. You are all in the same boat, thus all start closing out your shorts at the same time. As you line up to do so, your pain intensifies, because all those buy orders being placed are driving the stock price even higher. That searing pain you’re experiencing is called a short squeeze.

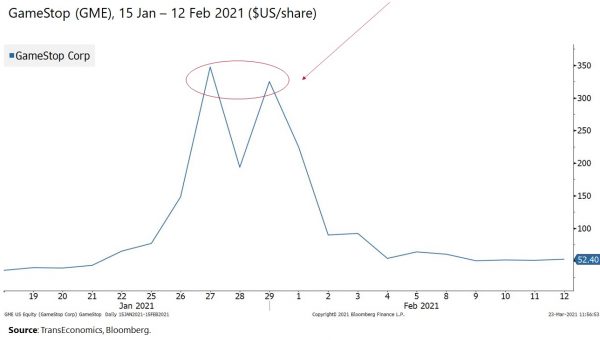

Can you please show me a picture of the January GameStop short squeeze?

Sure. Here it is:

The January GameStop short squeeze

As you can see, after the January short squeeze, the share price skyrocketed (it reached an record $483 from its 31 December 2020 price of $18.84). Later, it did settle down, to $53.50.

I see. So, what is it that you can’t fathom?

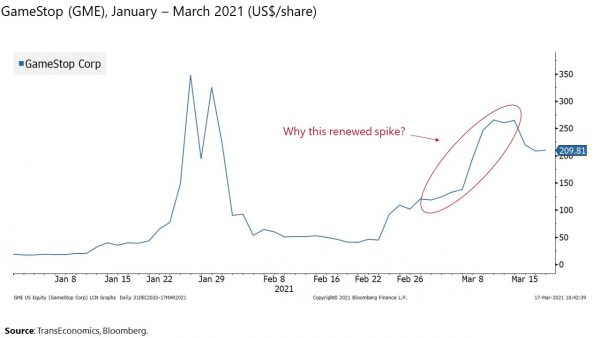

I can’t figure out why, after having settled down, the share price began spiking again.

That GameStop share prices resumed spiking is a puzzle

As Matt Levine points out,

Maybe there aren’t as many buyers now as there were in January, but there also aren’t as many sellers …There’s nobody left to sell: Long fundamental institutional investors are gone, and no short seller is going to touch this thing after what happened to the shorts in January.

I see. Yikes. You’re a professional money manager and can’t fathom something going on the market? How does this make you feel?

No more humble than usual. Markets are mysterious and unpredictable (this is why I’m always so careful to broadly diversify client portfolios).

Although I will admit, when I see Matt Levine stumped too, it does comfort me. Matt Levine is one of my favorite financial journalists—besides being extremely funny, he’s extremely smart. So when, last week, in pondering why GameStop was spiking again, he wrote, literally, “I don’t know”, I felt … less alone in the world!

Near the end of that piece, by the way, he throws out the best story he can come up with:

The story of GameStop might be that, over the course of late January and early February, it migrated from being a regular stock, with institutional investors and short sellers and the whole normal ecosystem of the stock market, to being a pure Reddit plaything, with an investor base made up of (1) diamond-hands-y Redditors and (2) locked-up insider and index-fund holders, and with any sensible short seller too terrified to get involved. It has just become unmoored from the usual rules of financial markets, in which stock prices are at least loosely tied to ideas about future cash flows and fundamental value. Redditors want to trade it, and no one else does, so it has become its own special thing.

I’ll buy that. If, in coming days, anyone asks me about GameStop, I’ll shrug my shoulders casually and say, “I’m with Matt Levine: GameStop may have morphed into a pure Reddit plaything.”